Bonds and promissory notes

Instruments for diversifying the sources of corporate financing

ICO’s catalogue of products also includes complementary financing instruments to enable companies to diversify the channels through which they secure resources for their development plans as a means of boosting their growth.

Through the development of these instruments, ICO contributes added value to corporate financing, expanding the range of products on offer and promoting additional sources of financing.

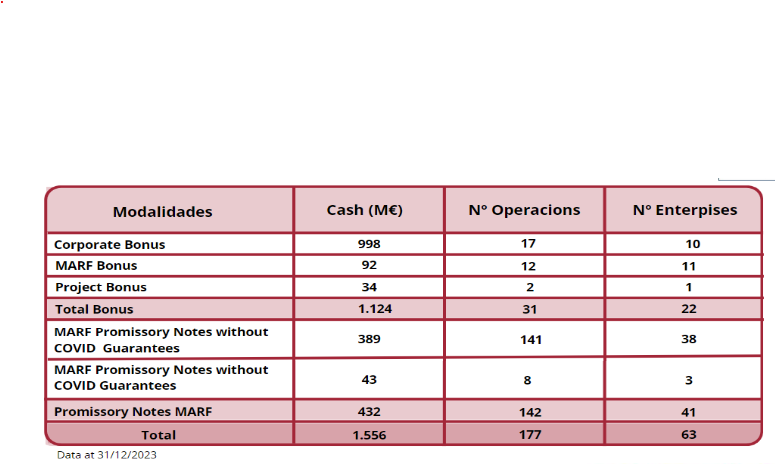

- Programme for the Purchase of Corporate Bonds and Promissory Notes issued through the Alternative Fixed Income Market (MARF): aimed at helping issuers, especially medium-sized companies and midcaps, to access financing to cover their short- and medium-term liquidity needs.

- Purchase of corporate bonds programme: issued by Spanish companies that are preferably certified as responsible issuers or listed in sustainability indices, providing companies with the necessary financing to undertake their medium and long-term investment plans.

- Purchase of project bonds programme: as a financing instrument particularly linked to large infrastructure financing operations.

- Asset-backed securities programme: the ICO began its work as an investor in asset-backed securities in 2017, when the ICO approved a framework for investment in bonds, in accordance with its Strategic Plan. This framework establishes the characteristics of the operations to be considered in terms of asset type, credit quality and period. ICO's participation seeks to ensure an impact on new credit-granting in general, and credit aimed at the productive framework in particular, as well as alignment with its objectives, particularly its sustainability objective. Towards the end of 2022, ICO had invested close to 1.3 billion euros in more than 10 operations.

In addition, to complement our product catalogue, we also collaborate in new forms of financing, participating in Aquisgrán, a pioneering initiative in Europe that finances SMEs through Mutual Guarantee Societies (MGS).

Aquisgrán Loans

ICO participates in Aquisgrán, a pioneering initiative in Europe, which finances SMEs and the self-employed with long-term loans guaranteed by Mutual Guarantee Societies (MSG). In this way, SMEs and the self-employed living in Spain improve their access to credit, diversifying their sources of financing and complementing the traditional banking channel.

Aquisgrán finances the loans through the issuance of up to EUR 260 million in securitization bonds progressively subscribed by the ICO, backed by a bilateral guarantee from the EIF (European Investment Fund) , and which are listed on the Alternative Fixed Income Market (Mercado Alternativo de Renta Fija: MARF).

Since its creation in June 2021, Aquisgrán has financed more than 2,000 SMEs with loans of an average amount of €80,000 and an average term of 6 years.

More information: Aquisgrán’s website