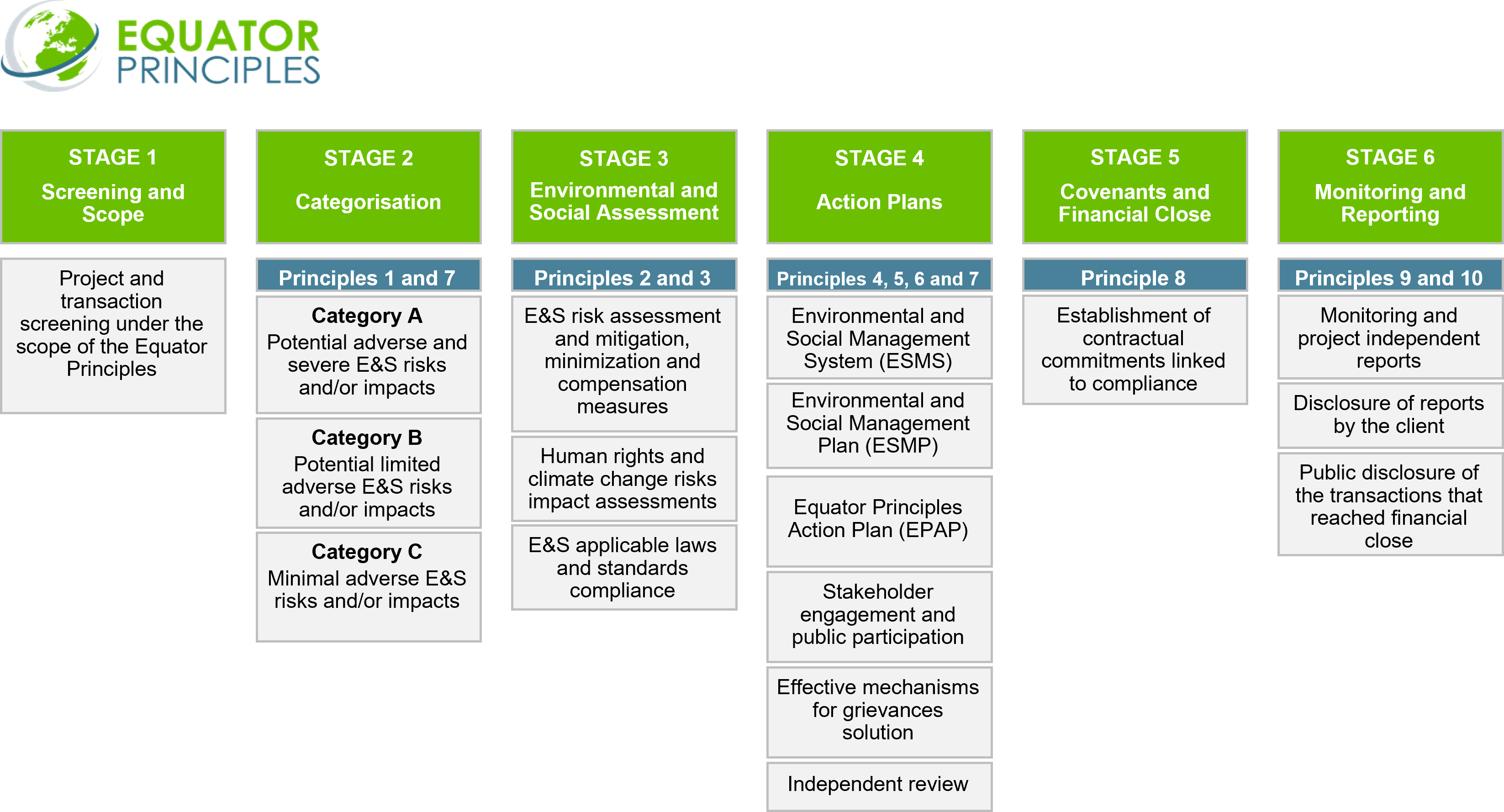

For ICO, risk analysis which includes and considers the indirect impacts of the financing projects does not respond solely to the fiduciary duty conferred by its public nature and its vocation as a Development Entity, but also to the demands of all its stakeholders.

Under this premise, ICO will rigorously analyse all social and environmental risks of operations falling under the "scope" of the Equator Principles, and which will be applied to new financing projects in all countries and all economic sectors.

- Project finance advisory services where total Project capital costs are US$10 million or more.

- Project finance with total project capital costs of US$10 million or more.

- Project-related corporate loans where all of the following three criteria are met:

- The majority of the loan is related to a Project over which the client has Effective Operational Control (either direct or indirect).

- The total aggregate loan amount and the EPFI’s individual commitment (before syndication or sell down) are each at least US$50 million.

- The loan tenor is at least two years.

- Bridge loans with a tenor of less than two years that are intended to be refinanced by Project Finance or a Project-Related Corporate Loan that is anticipated to meet the relevant criteria described in 2 and 3 above.

- Project-related refinance and project-related acquisition finance, where all of the following three criteria are met:

- The underlying Project was financed in accordance with the Equator Principles framework.

- There has been no material change in the scale or scope of the Project.

- Project Completion has not yet occurred at the time of the signing of the facility or loan agreement.

While the Equator Principles are not intended to be applied retroactively, the EPFI will apply the Principles to the financing of expansions or upgrades of an existing Project.

* Project-related corporate loans include loans to government-owned corporations and other legal entities created by a government to undertake commercial activities on behalf of the government and Export Finance in the form of Buyer Credit.

Project-related corporate loans exclude Export Finance in the form of Supplier Credit (as the client has no Effective Operational Control) and other financial instruments that do not finance an underlying Project, such as Asset Finance, hedging, leasing, letters of credit, general corporate purposes loans, and general working capital expenditures loans used to maintain a company’s operations.

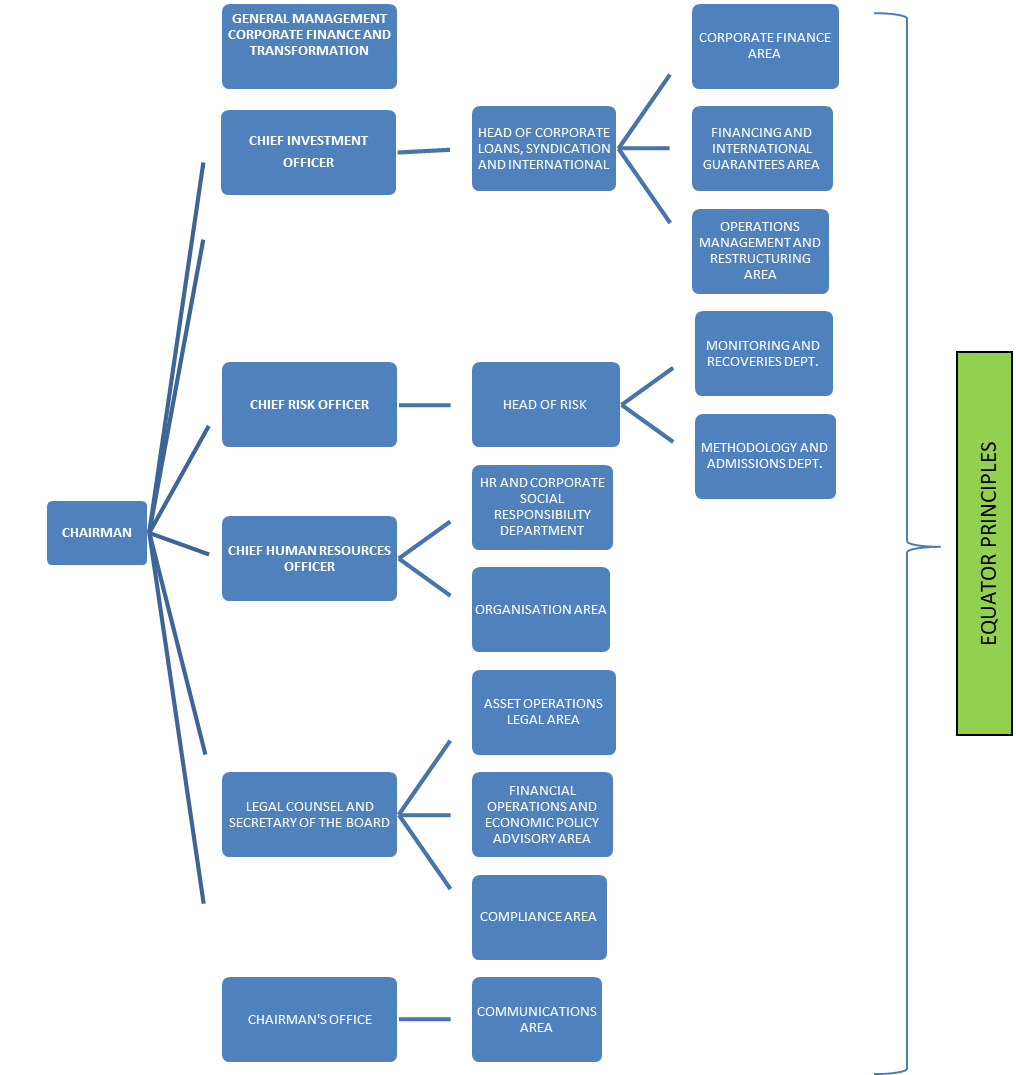

Taking into account the values and mission which underpin ICO, in October 2016, it adhered to the Equator Principles with the aim of improving its risk management system on large financing projects through identifying and mitigating any potential negative impacts which these projects could cause on the environment, on people, and on the climate.

Taking into account the values and mission which underpin ICO, in October 2016, it adhered to the Equator Principles with the aim of improving its risk management system on large financing projects through identifying and mitigating any potential negative impacts which these projects could cause on the environment, on people, and on the climate.