Fond-ICO Pyme

Endowed with 250 million euros

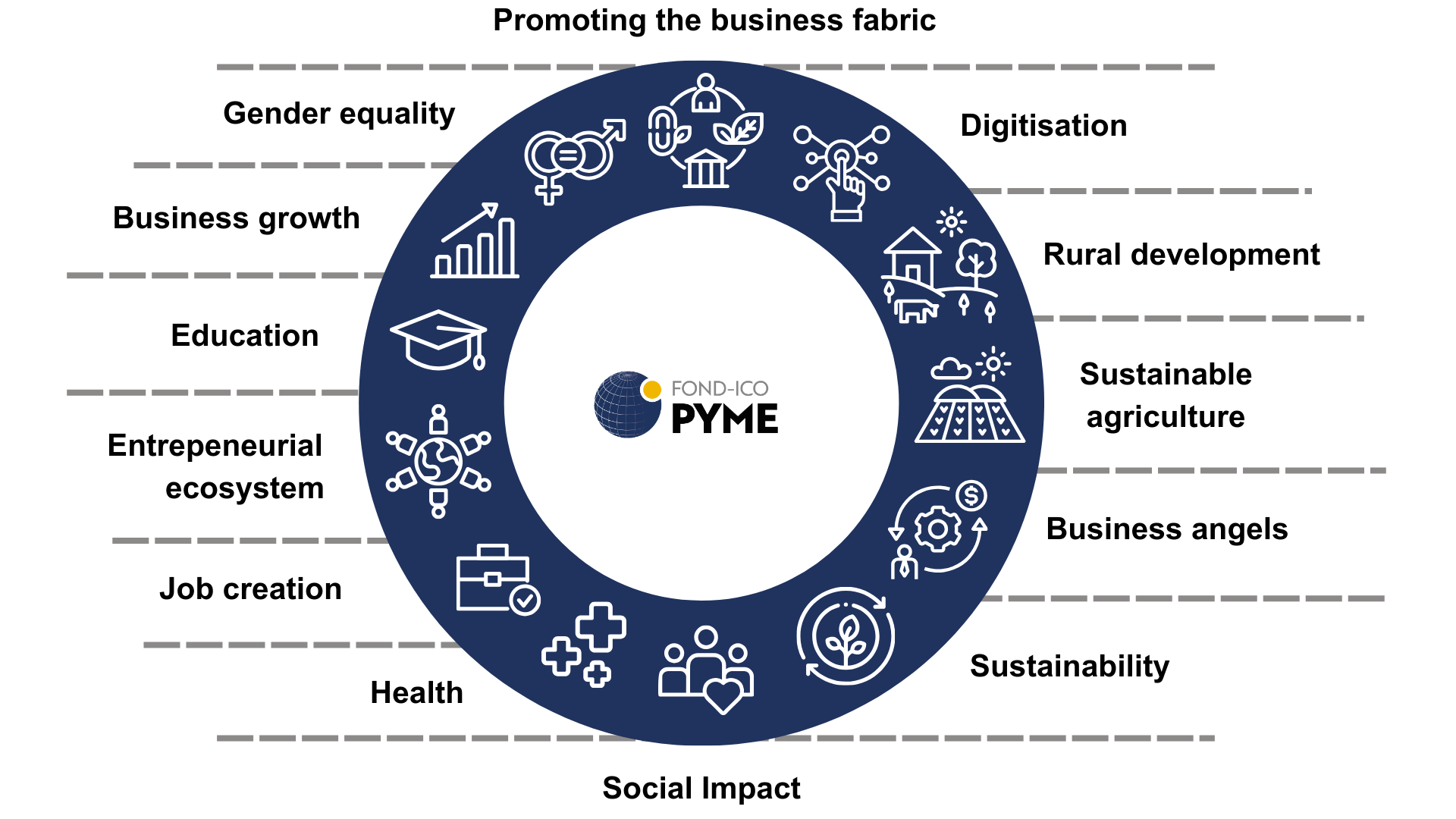

ICO SME Fund: Sustainability, digitalisation and social impact of the entrepreneurial ecosystem

The ICO SME Fund was the first fund created by Axis and has a size of 250 million euros

What is the objective of the ICO SME Fund?

This fund was set up in 1993 with the aim of promoting the growth of the business fabric and job creation through participation in Spanish SMEs, with equity and quasi-equity instruments.

It now operates mainly by investing in funds that in turn invest in strategic or innovative activity segments, such as sustainability and social impact or the entrepreneurial ecosystem, as well as promoting complementary financing to bank loans through different financing types: business angels or diversified debt (crowdlending/crowdfunding).

With investments from the ICO SME Fund, Axis contributes to the consolidation of the entrepreneurial ecosystem, job creation and the economic stimulations, while also mobilising private sector resources.

This public-private partnership model pays special attention to supporting strategic projects focused on digitalisation and sustainability.

Where do we invest?

The ICO SME Fund's investment strategy focuses on channelling resources to companies through co-investments with other venture capital funds and investments in funds that are especially dedicated to sustainability and social impact, as well as business angels and diversified debt.

The ICO SME Fund also contemplates investments in Spanish companies with a certain degree of maturity that want to finance their expansion process or, to a lesser extent, are in its early stages, either through loans or equity participation, always in co-investment with other private equity funds, on a minority basis, without becoming a reference partner, and only for a limited time adapted to the project's period of maturity.

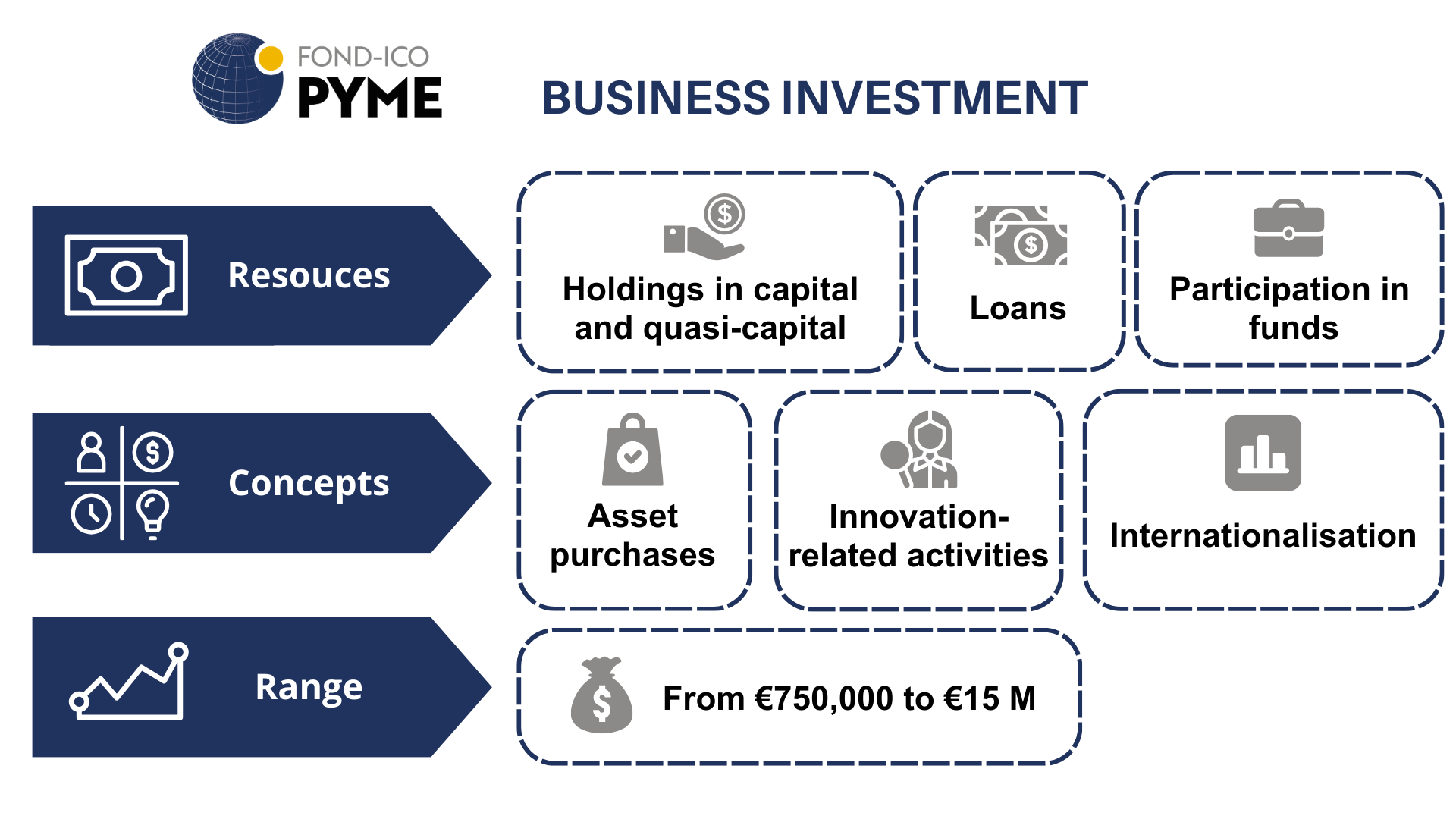

What are our resources for?

The resources that we invest go to financing companies’ expansion, which specifically include:

- Innovations.

- Asset purchases.

- Internationalisation.

And expressly exclude:

- Debt restructuring and refinancing.

- Working capital requirements.

- Substitution of shareholders.

What is the investment range?

From 750,000 to 15 million euros, with a target average investment of 5 million euros, depending on the contribution from the co-investor fund.

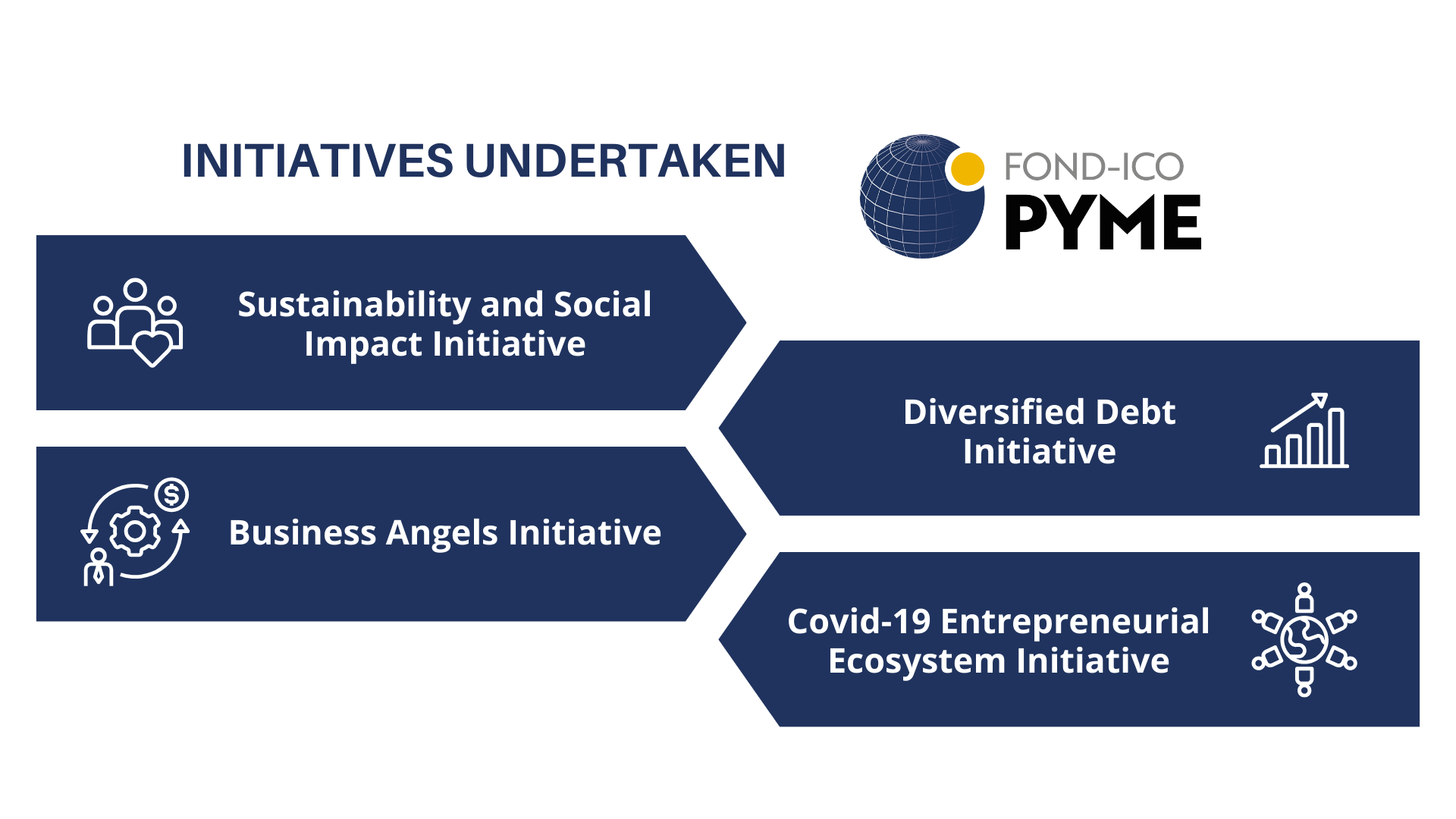

Different Initiatives developed by the ICO SME Fund

Within the framework of the ICO SME Fund, a series of initiatives have been developed to foster financing that is complementary to bank financing, thus allowing for participation based on objective criteria in certain strategic activity segments (sustainability and social impact) and financing types (crowdfunding, crowdlending, business angels), providing greater flexibility and reducing the material and management costs of certain participations.

The ICO SME Fund invests in the following initiatives: